Some people believe that leasing a car with bad credit is impossible. However, car leasing…

Some people believe that leasing a car with bad credit is impossible. However, car leasing with a bad credit score is available for everybody if you prepare. Your credit file serves as a kind of representation of your financial capability.

In some way, it may impact the conditions of your future lease if we talk about flexibility. For instance, a high credit score helps you choose and negotiate some features of your agreement that work in your favor.

There are more factors you may want to consider before leasing a car with bad credit. So let’s start from the very beginning.

Leasing a vehicle is an agreement for driving the new car with the cost built on car depreciation.

It is getting more popular than buying an auto. This type of car temporary ownership gives you an opportunity to drive a new model car and save money.

In general, the system consists of 3 aspects you should know:

Firstly, you have to analyze your driving habits and common routine. It helps your personal expert choose the most appropriate car for you. Tell honestly how often do you make long trips, where do you usually go, and discuss the needed annual mileage. It affects further activity and the total price.

In general, it means the price of your lease which is built on the difference between the car’s price provided by the company when you start using it and the value at the end of the lease term. Thus, if the vehicle is worth $20,000 when you just come to your lease provider and it will cost $9,000 after 36 months, the lease cost will be based on $11,000.

One of the advantages of car leasing is the fixed amount of money you have to pay regularly. You will have monthly payments based on the car depreciation, interest rate, and annual mileage. Also, you can make the initial payment as a cap cost reduction. Some extra fees are not always required. They should be negotiated with your personal expert.

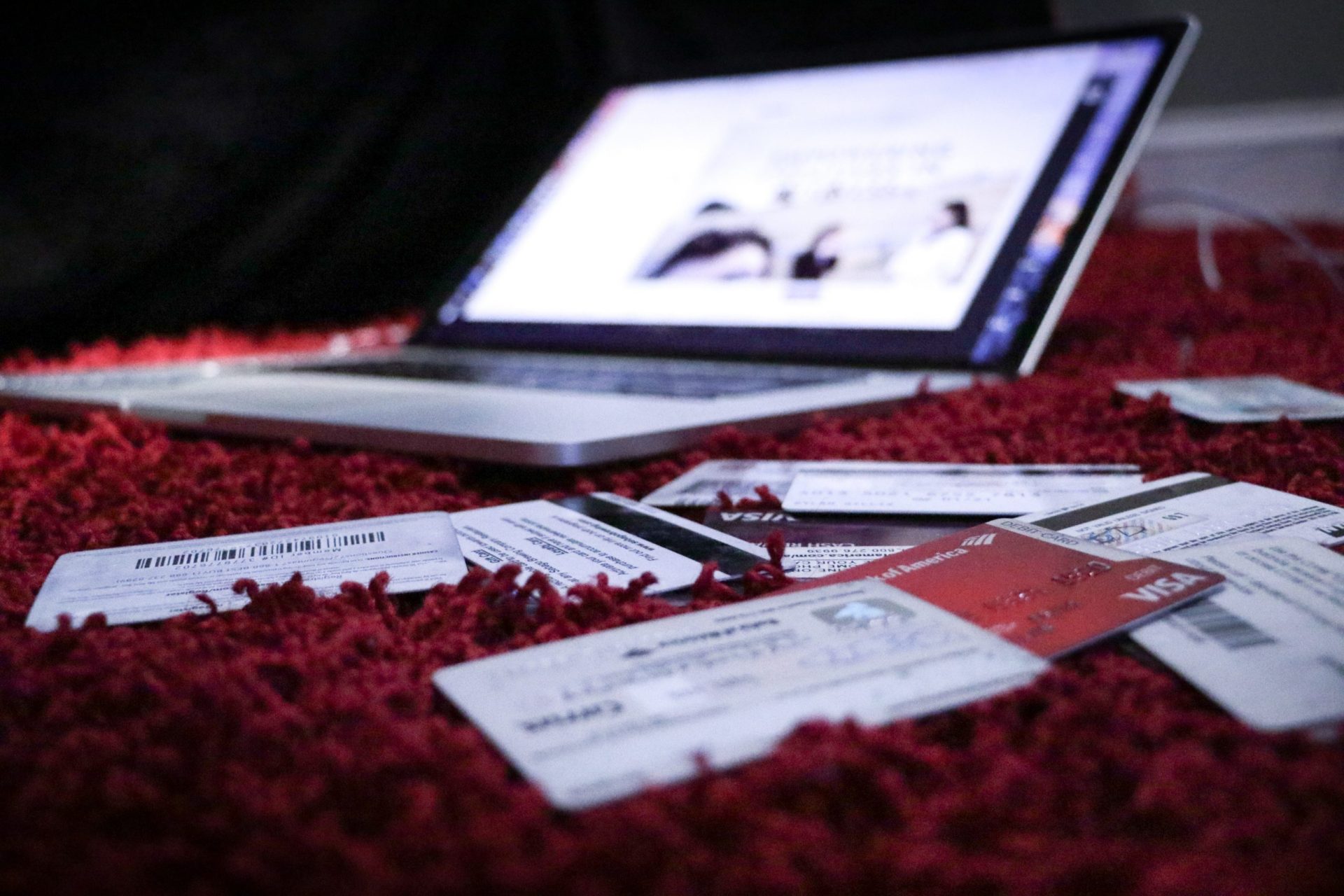

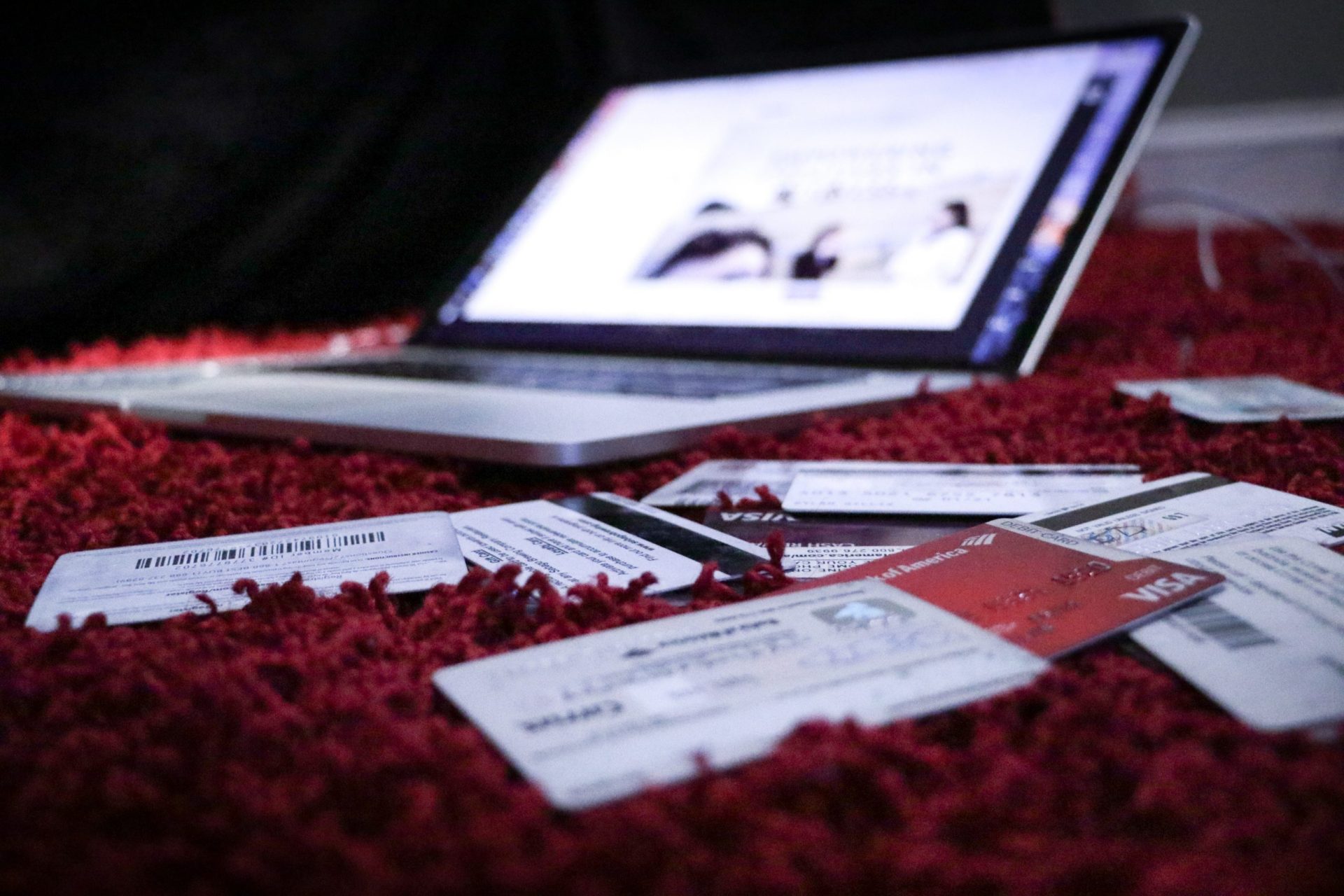

In fact, the higher your credit score, the better for you and for the company. You should understand that the exact credit score can differ depending on the dealership. According to NerdWallet, a score between 680 and 739 is the perfect one among leasing companies.

FICO Auto Scores which are the most authoritative sources in the auto industry range from 250 to 900. It gives the companies “a further-refined credit risk assessment” for leasing a vehicle.

According to FICO, an average credit score as an eligible one ranges from about 580 to 740. If we talk about the “bad” credit score, it is the number under 580.

Some leasing companies may not offer anything to credit-challenged customers.

If you enter the market to lease a new auto, improve your credit scores to make sure the company will have no doubts about your further cooperation.

There are the extra costs associated with leasing that may occur with bad credit borrowers.

Also, when applying for a lease with a poor credit score you should be aware of possible outcomes. There are several examples:

But it doesn’t mean that your lease is not going to work the way you wanted to.

The point is that there’s not a specific credit score that’s needed in order to qualify for a lease. Every case is individual and it’s important to look into the details of your file attentively.

Building your credit history is another process that requires enough attention and a responsible attitude. In this case, leasing a car can help you to do it well by adding an installment account.

The leasing company will report your regular payments every month to the credit reporting agencies. If you do the payments on time, it will boost your credit score.

What should you do beforehand?

The ways to get the car lease with bad credit are explained in an exclusive interview with Grand Prix Motors CEO.

“Everyone with a score between 600 and 700 can obtain a car”

says Lenny Komsky, Grand Prix Motors CEO, who is also an expert in this field.

“Bad credit is generally considered a score under 600. However, when it comes to car leasing it is usually a matter of individual investigation rather than an issue of bad credit for each particular lease. Bad credit can mean that a person has a previous credit debt he or she didn’t pay off and has a score of 650. This person can struggle to get the best lease conditions. On the other hand, there can be cases of people getting the best condition on a Lexus lease deal with a 620 score. That can happen if a client with a 620 score took out loans for high school and their credit score went down as a consequence. Particularly if she had taken out a lease before, paid it out on time, and the bank saw it. Thus, every time a person takes a lease his credit score, his credit history, and previous car leasing experience are studied individually.”

If you want to lease a car and are uncertain about your credit score, reach out to our car leasing expert for a consultation!

Find out your credit rating

An official credit score is a summary of your standing as someone who takes care of credit responsibilities. Then, your credit report is a full summary of your history as a consumer and reliable debtor.

You have to be aware that frequent checking your credit score can negatively affect this score. It certainly will be helpful to get a copy of your report and bring it to the dealership when you visit.

You should arrive at the dealership or leasing agent with the relevant proof of your steady income and copies of payments.

Moreover, you should have evidence of an income that is more than sufficient to take care of your monthly payments. It is one way to ensure you are eligible for a lease even with a poor score.

Show that you are working to improve your weak credit score, and even include professional and personal references. Verification of prior leases you’ve had with exceptional payment history will be helpful as well.

Use your initial payment as a capitalized cost reduction. The upfront payment is not usually required but thus you can prove that cooperation with you won’t be risky. It will lower the amount of your lease and your monthly payments.

Therefore, it increases your chances of being approved for a good deal.

Co-signing means the person is ready to make some payments if you can’t.

Having somebody with a high credit file to take responsibility for your lease can help convince the leasing company that payments will be made on time. It will be the question of shared responsibility.

Consider asking someone like a family member or friend to co-sign your lease. But remember that your co-signer is on the hook if you fail to pay, so make sure whoever you ask is fully aware of their responsibility.

Leaseholders who want to get out of their leases sometimes offer to let someone take over the lease for them. The experts call it lease transfers. When you get a car this way, you take responsibility for monthly lease payments under the same terms as the original lease.

To sum up, it’s possible to lease a car with bad credit but you may receive a lease offer less favorable than you anticipated. If you have time, taking steps to improve your credit score could result in a better lease agreement in the future. Though if you doubt your chances for a good deal, don’t hesitate to let us help you here. Your personal assistant will make sure to get you the best deal possible!

#enjoy your freedom with Grand Prix Motors!

Hear about the latest offers first, before everyone else.

Submit your desired Car and we will contact you shortly.