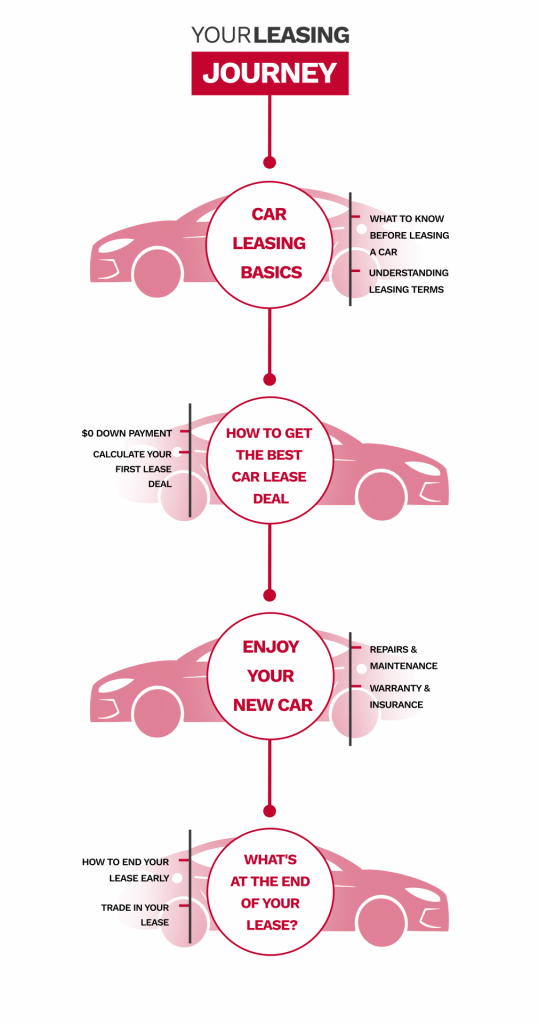

In this guide, we are going to tell you about the current situation of the market, reveal how leasing a car works and how you can get the best car leasing deal possible.

If you wonder whether you are on the right path considering leasing then the answer is YES.

Leasing offers you freedom and saves you money. This guide reveals the most complete description of car leasing and its peculiarities.

After reading this guide you will become a lease expert yourself and will be fully armed for your best car lease deal. You gain the theoretical experience to use it in practice.

Besides, the world has changed after Covid-19 and we are ready for that. You can stay safe at home and lease your new car completely online with Grand Prix Motors!

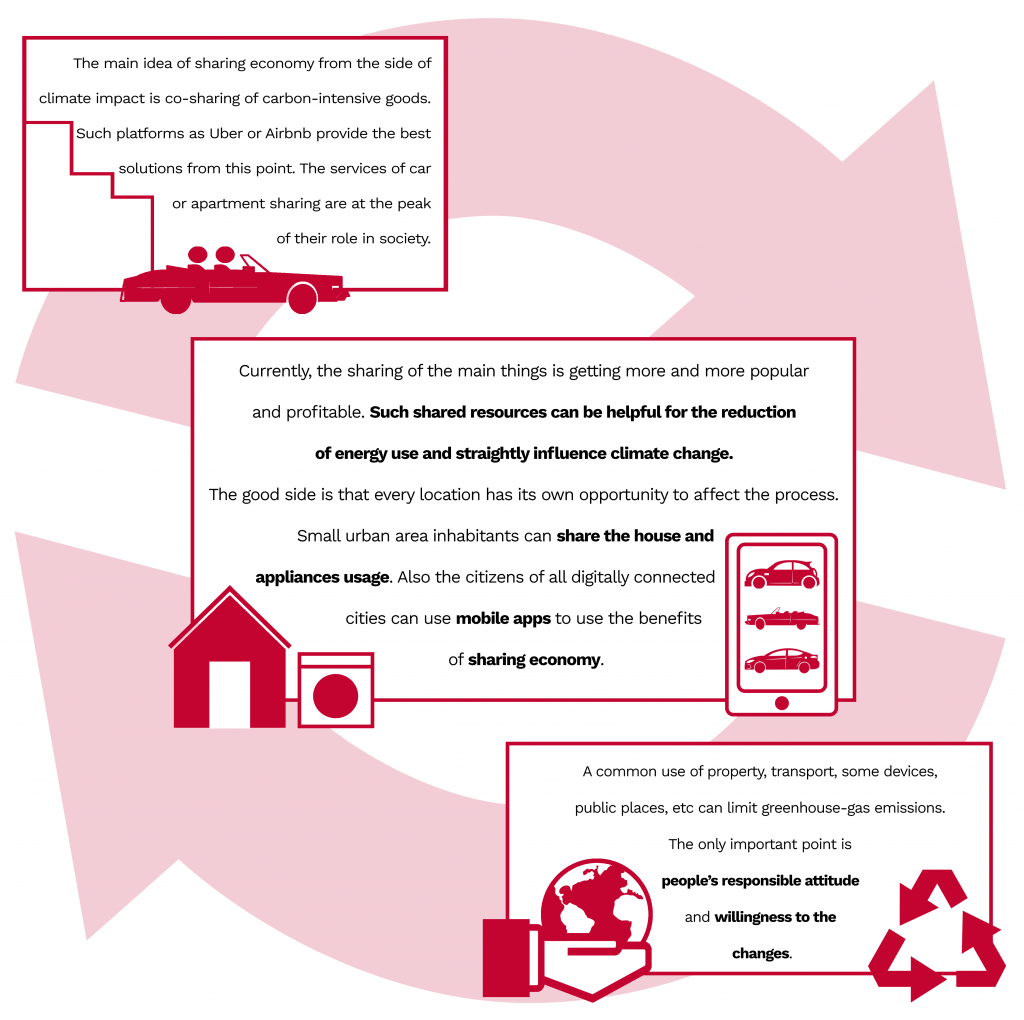

At present, the world experiences huge changes. We face the new tendencies of sharing economy and zero waste philosophy, and steadily it becomes our routine.

Leasing is a part of this life-changing concept and it really makes a difference. Choosing to lease you contribute to climate change solutions and you do it effortlessly.

2021 brought us enough stress, so dealing with a long-term loan will get you more hassle.

When you choose to lease you let the company care of all the selling and trading issues.

While you are busy making up your mind on the make and model of your future car.

After several lockdowns with many restrictions, the economic changes affected the automotive industry. As a result, we have the risen prices for cars and sometimes limited choice. But it changes when we talk about the notion of leasing.

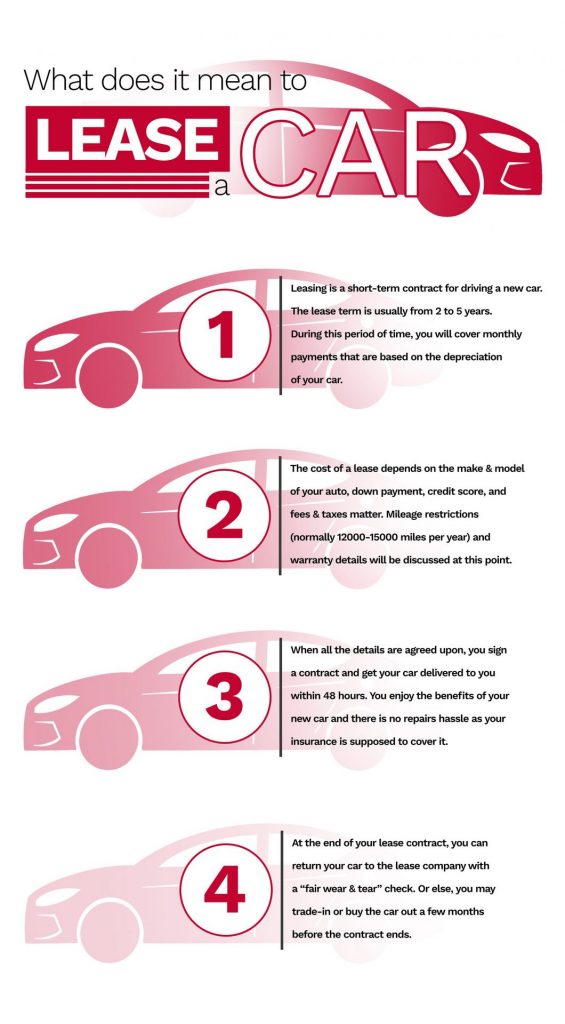

What does it mean to lease a car?

We are going to explore every detail of how does leasing a car work. Moreover, you can contact us to ask about any make and model and we will do our best to satisfy your needs!

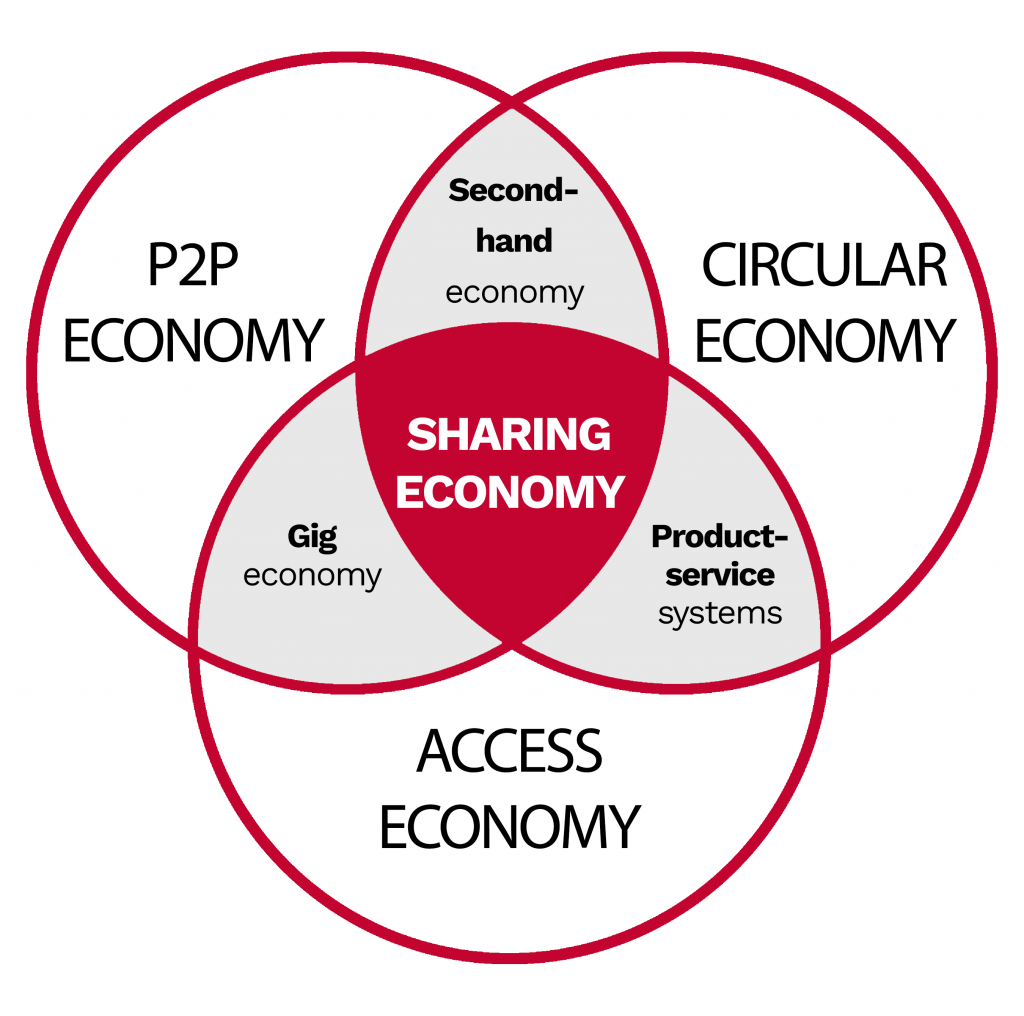

Sharing is caring

Nowadays this phrase gains a new interpretation. Sharing economy ideas are becoming more and more popular. Let’s see how does leasing a car work in terms of sharing economy development.

Modern generations are ready to make a difference. Sharing things and making this consumption useful for the environment can become our routine.

The notion of sharing economy is also known as collaborative, access, or gig economy means sharing the services or things for a free or fixed charge.

Such peer-to-peer lending is the process when you need something and try to find somebody who has it to share with you and vice versa.

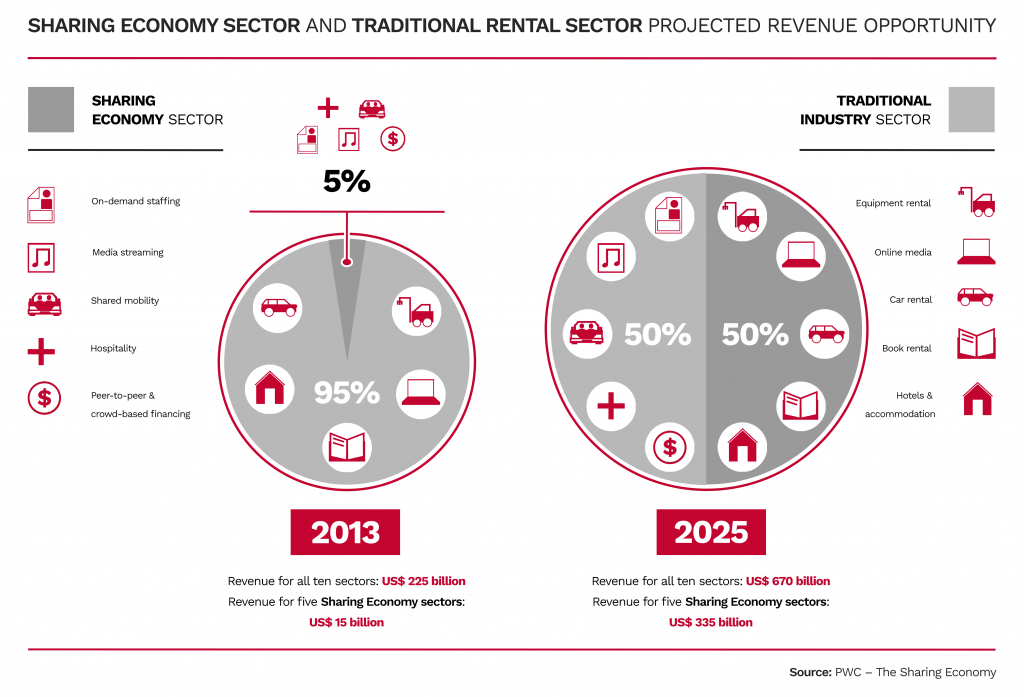

Sharing economy tools are vital for the automotive industry. They shape the automotive trade by giving easy access to a lot of features for low payments. It attracts drivers more than possession and full permanent ownership.

The amount of car-sharing and ride-hailing firms increases and it provides long-term access to shared cars for affordable prices. Because it’s based on profitable conditions, the tendency increases rapidly and spreads among Americans.

The first input to the changes is the reduction of overproduction. Ford wants to shift more future buyers to the vehicle ordering process. The company contributes to the customized ordering of the exact vehicle — color, trim level, accessories, everything, according to the customer’s needs and even unreal wishes.

“We are really committed to going to an order-based system and keeping inventories at 50 to 60 days’ supply.”

Ford CEO Jim Farley

Another step is that car manufacturers change their philosophy. Volkswagen acquired the stake in the ride-hailing app, BMW and Daimler united the services of car sharing, Toyota started its own car hire service. In 2018, BMW company even moved a step forward and launched a new lease program for sharing economy.

Currently, car leasing companies’ role rises as well because of their affordability and ideas. Leasing becomes something more than a kind of car ownership.

There is a big difference between driving a car for a few years with its newest eco-friendly features and being a rough driver with the same car for 10 years.

People use leasing to carry a special personal mission — to save not only their costs but our environment as well. It moves the society forward.

For example, the common fact that electric cars are not so harmful to nature attracts many drivers. Although there are not so many people who can afford it and they try to find something much more appropriate when thinking of buying a vehicle.

The best solution, in this case, is to lease a hybrid car that can show you a great driving experience and prevent a bad impact on the environment.

2021 has been a quite tough year for the automotive industry for another reason as well. The carmakers suffered from the semiconductor chip shortage as an effect of Covid-19.

The pandemic prompted chip factories first to cancel shifts and then to shut down early last year. It affected severely the supplies of some manufacturing companies.

The majority of the processors are made particularly overseas. Because of the closed borders for some period of time, it made things worse.

As a result, the production and distribution of chips reduced drastically. Ford, General Motors, Fiat Chrysler (Stellantis), Volkswagen, and Honda seem to have struggled the most.

“It is estimated that the chips shortage will be resolved through 2022-2023.”

Senior Principal Analyst – Automotive, IHS Markit, Phil Amsrud

Some automakers have done their best and diverted chips from slower-selling models to those in high demand. Among them are models such as pickup trucks and large SUVs.

Together with rising consumer demand, this has led to an increase in the prices of new cars. The percentage of buyers paying above sticker price has risen more than 50% year over year — from 8.1% in April 2020 to 12.7% in April 2021. That’s the highest percentage since 2002.

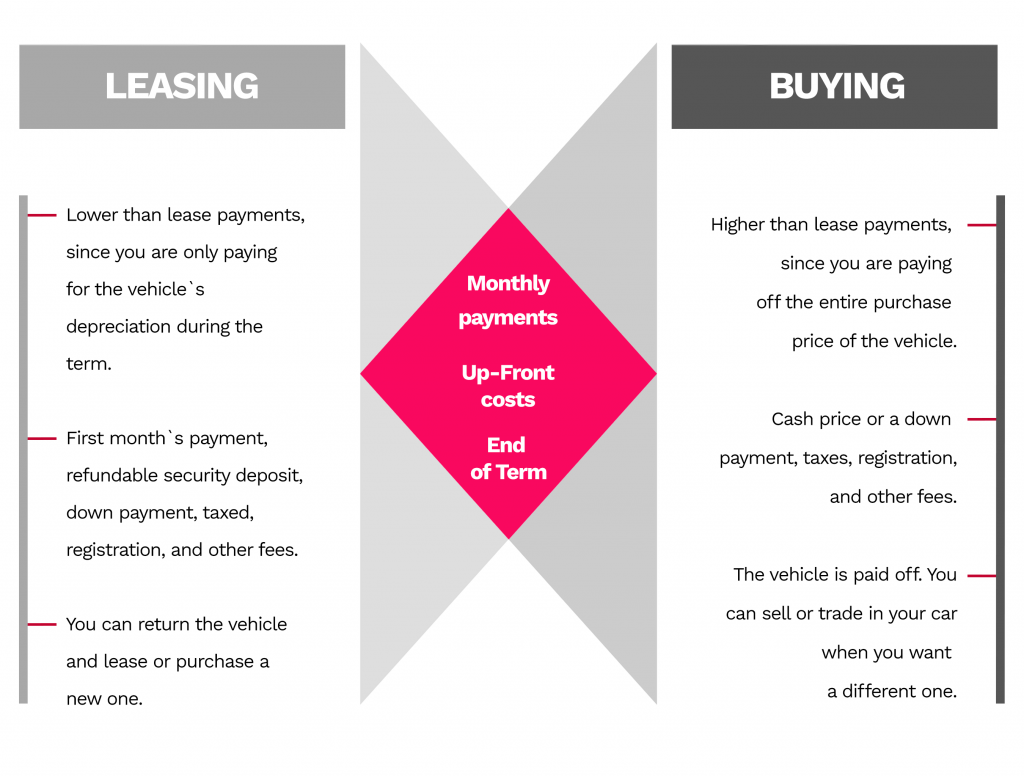

When choosing the best option possible it is a good idea to consider both leasing and buying a car. We will take a look at the pros and cons of both and find out the key differences. So, how does leasing and buying a car work for you?

Most customers get a new model every 3-5 years. When leasing a car you will rent a brand new auto that is usually covered by the manufacturer’s new-car warranty. Moreover, you drive the car during its most trouble-free years.

When leasing you get a car making lower monthly payments. While buying you will pay the full retail cost divided into monthly parts.

This way you are not responsible for all the trading hassles you face after buying a car. While purchasing a vehicle you are going to deal with the fluctuations in the car’s trade-in value.

Buying a vehicle with a car loan you choose higher monthly payments for several years.

With each payment, you put part of it towards paying interest on the loan, and the rest is used to pay down the principal.

Some car buyers opt for longer-term car loans of six to eight years to get a lower monthly payment. But you may get ‘upside down’ when you owe more than a vehicle’s price.

Leasing a car offers you a new car to drive for significantly lower monthly payments with fixed conditions and negotiated rules.

So leasing means you only pay for the depreciation of that period and not the whole car cost.

Roughly speaking if we take the same make & model vehicle to compare, leasing will be more beneficial of a financial matter.

Leasing provides you with an option of zero down payment, while buying doesn’t. It practically means that when you get a new car lease you don’t make a deposit upfront.

When you get a lease deal you may choose to pay your first month’s payment and fees (refundable included) and drive off your nice new car straight away. If you choose to buy a car you will have to pay the cash price of down payment, taxes, registration, and other fees.

As you own a car you are able to drive as many miles as you can afford. Thus buying makes it possible to only maintain the repairs of a car after that.

Leasing has some mileage restrictions though with more people than ever working from home, it may not be a factor. Many might find they don’t use the miles they have paid for.

When leasing you are not paying off the entire purchase price of the vehicle and the interest rate may be lower with a good credit score. Grand Prix Motors lease expert may advise you with the best option of down payment to make your monthly payment even more affordable.

Car leasing is smart if you’re on a tight budget as the monthly payments for the same car will differ drastically compared to the buying. Some people even opt for a more luxurious car than they otherwise could afford.

If you don’t expect to drive less than the mileage limit annually, you may ask your company to lower the yearly allowance. That way, the residual value – or “buy-back” – will increase. That reduces the amount you have to finance, which should lower your monthly payment more.

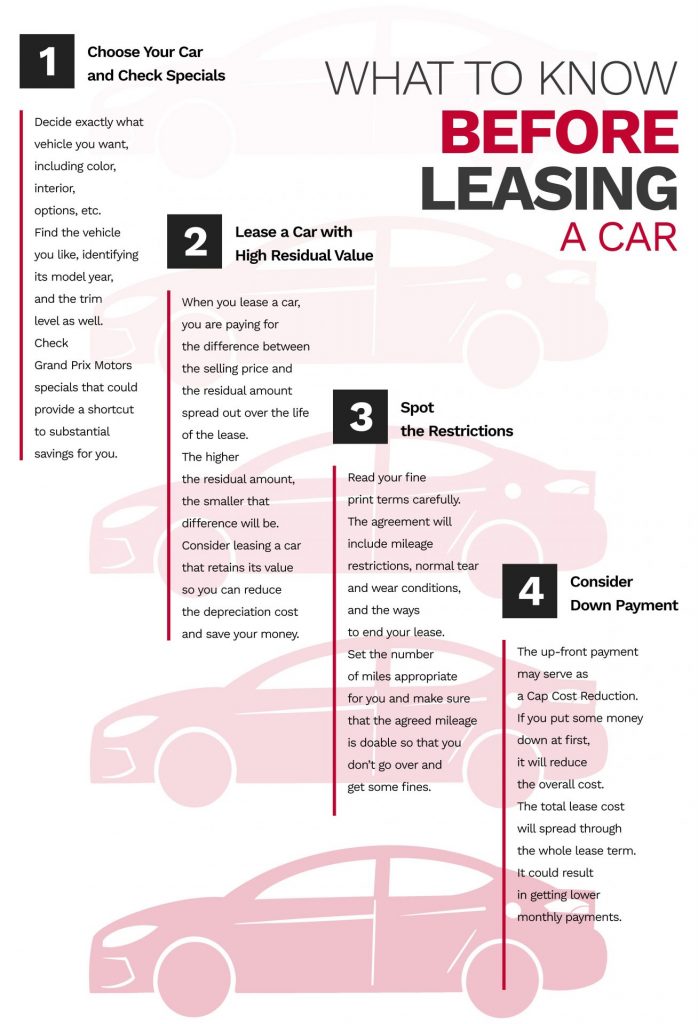

While leases don’t necessarily involve down payments, you may want to make the initial payment though. That is called a cap cost reduction and is used to lower the monthly payments and the whole price on the lease.

Leasing certainly has some advantages over buying in the regard of changing your wheels every couple of years. You may drive a high-end vehicle for a very affordable price.

Luxury cars can offer low-price lease arrangements because the cars have a higher residual value. That means that the cars are worth more by the end of the lease term than what non-luxury models will be after the same period of time.

And since you will only have use of the car for a few years, dealers can often make them available with very attractive terms. When the lease is up in a few years, you can return it to the company and get your next new car.

With a car lease, you’re getting a new car for the first trouble-free years.

The leased car always has a manufacturer warranty that covers the repairs and maintenance during your lease agreement.

To reassure the leasing company you may provide your car with additional insurance coverage. It is also a good idea to secure yourself with another level of protection like collision, comprehensive, and gap insurance.

With a lease, you simply return the car and just walk away at the end of the contract. This way you fulfill the basic agreement and have to surpass the car check.

There’s no hassle with selling your used car to a dealership or a private buyer. When you know details of how does leasing a car work, it makes your life easier. You are free to choose your new nice car and enjoy your ride.

Car is not always an everyday necessity. Sometimes it’s only a tool for a certain period of time.

For example, you are going to take a job in a remote location and only need a car for one or two years. It may be more cost-effective—and less hassle—to simply get a car lease deal for only as long as you need it. Another example is your lifestyle.

For your immediate needs, you may want a certain type of vehicle, but know you’ll need something different just a few years down the road. If you just got married and are expecting to have kids, you may want to drive something fun for now but will need a minivan later.

Typically lease payments will be lower than loan payments because you only pay for the depreciation of the vehicle during the lease, plus interest, rent charges, taxes, and fees.

While loan payments are based on how much you owe on the price of a vehicle, lease payments are based not on the car’s retail value, but on the amount of the car’s value that will depreciate during the time of the lease.

Leasing can be a great deal for borrowers who want to spend less on their vehicle payment each month but still want that new car smell.

Unlike loans, car leasing deals usually don’t require any money down. Grand Prix Motors provides zero down payment by default and if you want to put some upfront money it is better to consult your personal lease expert.

You may want to do so because it is going to work as a capitalized cost reduction. It means that the upfront payment will make your monthly payments reduced. And you agree on it with your lease expert, particularly to your make and model.

Depending on how leasing a car works for you in a financial way, you can put money upfront. It may include the first month’s payment, a refundable security deposit, down payment, taxes, registration fees, and possibly other fees.

Your lease agreement will specify who must pay for maintenance and repairs during the lease term and what kind of car insurance is best in your case.

Normally leased cars are brand new, which means they’re covered under the manufacturer’s warranty. A warranty can offer customers peace of mind and security from possible damage.

You drive the leased car for the most trouble-free years as the car is equipped with the latest features and technologies. Car leasing deals typically end before cars require major service or new tires, so maintenance costs are usually low.

When your car is leased you don’t own it to sell to trade-in afterwards. At the end of your lease term, you simply return the car back to the leasing company and have a chance to choose your new one. All the hassle of selling the vehicle is now the company’s responsibility.

But even if you do want to own your leased vehicle, you can buy it.

You have the first right of refusal to purchase your leased vehicle for the residual value. This way you get your car and don’t spend extra money as the depreciation is already enrolled.

Leasing also gives you flexibility and a way to avoid the commitment for the long term. If you like to change your wheels every three years or you like to keep up with the new technology then leasing is probably right for you.

Once the lease term is up, you return the vehicle to the dealership and lease a newer and more technologically advanced car. If you don’t get emotionally attached to your auto and enjoy the benefits of reliable new models, leasing has it all.

Do you only drive your car a few days per week or use it for occasional trips? Well in this situation buying and maintenance may cost a fortune compared to the driving intention.

The lease contract will include the agreement of the number of miles you are going to drive per year. Usually, the mileage limit goes from 10 000 to 15 000 miles a year. But if you don’t drive that much, you may save some money.

Just as with any vehicle, your leased car depreciates in value as you accumulate more miles.

Naturally, you will pay some deductible taxes. If you use your car for business purposes, a lease will often afford you more tax write-offs than a loan.

According to IRS leasing allows you to deduct the standard mileage rate for the business miles driven or claim actual expenses, which would include lease payments.

An income inclusion amount reduces both of these deductions. For more detailed information our lease expert will provide you with a Free Consultation.

When you are not an expert, you might struggle with knowing how leasing a car works before leasing a vehicle. The knowledge is never enogh but you always can deepen it.

Becoming informed about how does leasing a car work is a key first step in being able to walk away from your lease satisfied when it ends.

As the catalog suggests you a massive variety of choices, select the make and model that fits your lifestyle. Decide exactly what vehicle you want, including color, interior, options, etc. Find the vehicle you like, identifying its model year, and the trim level as well.

Showing up at a leasing company knowing what you are looking for may play into your hands. Do your research ahead of time to find out what makes and models are the best for your needs. It is also better to give some serious thought to prioritize your preferences.

Tip: Check specials that could provide a shortcut to substantial savings for you.

Grand Prix Motors picks the best cheapest car lease Specials for popular car makes and models and posts them on its website every particular month.

If you are not sure about the specific car you would like to drive, you should prioritize desired features and contact the lease expert who will look for the best deal and might offer lease specials to help you save on your next vehicle.

If you get into the thick of how does leasing a car work, you will try to look for a vehicle that doesn’t depreciate greatly. The residual value is an estimate of how much the vehicle will be worth at the end of a lease.

When you lease a car, you are paying for the difference between the selling price and the residual amount spread out over the life of the lease.

The higher the residual amount, the smaller that difference will be. You should aim to lease a car that retains its value so you can reduce the depreciation cost and save your money.

Consider the length of your lease contract which may be up to 5 years or so. Leasing a vehicle often has a required amount of miles that you have to be within.

Usually, it is from 10 000 to 15 000 miles per year depending on the model. Before signing your lease, make sure that the agreed mileage is doable so that you don’t go over and get fines.

Сommon drivers need about 12,000 miles per year or even more. In general, the first rule will be connected with the underestimation of the number of miles you need. Almost every lease deal includes an annual mileage limit and due to this number of miles, you will choose an appropriate car. If you exceed the limits you’ll have an additional fee which is up to 30 cents per extra mile. So, if you broke the restrictions by 3,000 miles, at the end of your lease you would pay an extra $900.

Tip: Just tell honestly about your driving habits and everyday routine. Your personal expert will take it into consideration and you will be able to discuss a higher mileage limit.

A “money factor” is the lease term for what most people think of as an interest rate. Just as with a traditional interest rate, the lower the number the better.

Be sure to ask what is the money factor in your lease and convert it to an interest rate. It’s an easy way to make sure you’re getting a rate appropriate for your credit score.

You will also want to check your credit since you may need a healthy score to lease a vehicle. According to Experian, you may want to aim for FICO® scores of 700 or better.

Grand Prix Motors charges no additional service fee and provides 0 down payment options. Although you may consider the use of the up-front payment for the Cap Cost Reduction as the effect of a bigger down payment is getting lower monthly payments, just like a traditional loan.

The need for a down payment varies based on several factors, and the best way to know what suits you is to have a free consultation with our lease expert.

Fee amounts differ from brand to brand and from bank to bank. It is better to know what you’re paying and ask beforehand rather than being surprised at the end of the lease.

Surely, you want to sign up for the documents ASAP and enjoy driving your new car. We will sound like most psychologists now but we have to say it… Just talk! People sometimes avoid the process of discussions and totally omit bargaining in the process. A fair deal is your final goal, why don’t you do anything for it?

Tip: When you decide to lease a car, get ready to negotiate the vehicle’s cost. Don’t be concentrated on reducing your monthly payment. The decisive factor is the cap cost, so you should be focused on discussions about that point.

Leasing has some peculiar terms describing important factors that affect your lease cost. Understanding leasing terms can help you demystify this process and learn how does leasing a car work. We will have a look at some keywords and their definitions.

When you buy a car, you buy the whole thing. When you lease a car, you’re buying the difference between the negotiated sale price (including fees) and the predicted amount that it will be worth at the end of the lease term. This difference is named depreciation and will play an important part in your calculations.

This abbreviation stands for “Manufacturer’s Suggested Retail Price” meaning the purchase price that a vehicle’s manufacturer recommends it be sold for at the point of sale. It is also called a “sticker price” as it appears on the vehicle’s window sticker. The residual value of the vehicle is based on this number.

The amount that the car is expected to be worth at the end of the lease is called its residual value. Your residual value is based on your parameters.

First is the number of miles per year you drive, which is typically from 10,000 to 15,000.

Second is the term of the lease and it is up to you to choose while normally it may be 24 or 36 months and more.

Depreciation and Residual go hand in hand – if you know one, you can calculate the other.

If we take as an example a car for $30,000, after 4 years, the depreciation on the car is $20,000 – therefore, the residual is $10,000.

When you lease a vehicle you are paying for its depreciation, plus interest, tax, and some fees. o keep your monthly payments as low as possible, look for cars that don’t depreciate faster than average and hold their value.

Tip: Many car websites and magazines publish annual lists of good lease cars. Search for “best residual values” to find out how much the most affordable options are going to be worth.

Knowing how leasing a car works in terms of residual value can save you some money.

The residual value is set by independent companies, such as ALG (formerly known as Automotive Lease Guide), who are experts at estimating the future value of automobiles.

While traditional vehicle financing includes an interest rate, leases include a money factor, which is not quite the same as an interest rate.

The lease money factor represents the compensation you pay to the leasing company for the risk they take by trusting you’ll make all lease payments on time.

Visibly, a lower money factor means lower payments.

The money factor can be translated into the more common annual percentage rate (APR) by multiplying the money factor by 2,400.

The amount of money you need to pay to begin the lease is called the drive-off cost. It normally includes Acquisition Fee, Security Deposit, and lease fees.

Some people who want to reduce the number of their monthly payments will also make a cap reduction payment which obviously affects the price.

The selling price of the vehicle you are going to pay for is named Capitalized Cost or “Cap Cost” in a short form.

It is the value of the vehicle at the beginning of the lease in addition to any extra fees, taxes, and other possible charges. This amount out of other car leasing terms is negotiable and it affects your monthly payments.

All the factors that lower your Capitalized Cost are named Cap Cost Reduction.

The company provides you with an understanding of the total amount you must pay in the future. It includes the estimation of both with and without the capitalized cost reduction.

This way if you want to reduce the amount of the monthly payments, you will need to make some Cap Reduction payments upfront. This includes the down payment, trade-in allowance, rebates, and other things you agree with the company.

If you’re leasing a vehicle with a high selling price and a high money factor, you may be better off initiating that lease with a significant down payment. But if you’re leasing a more modestly priced vehicle with an incentivized special rate, beginning the lease with little to no upfront money may be the way to go.

Tip: Consider starting your lease with no money out of pocket, especially if your lease has a very low money factor. While many leases in the market have special low money factors, not all do.

A kind of payment that protects the leasing company if you go over the allowable mileage, damage the car or default on the contract is called a Security Deposit.

Usually, it is a fully refundable charge that can be equivalent to a single month’s lease payment.

You can use your security deposits as a part of your Cap Cost Reduction. It may lower your overall money factor, monthly payment, and increase your savings.

An acquisition fee is an amount that a leasing company charges to cover the administrative costs of setting up a new auto lease. It may also be called the assignment fee, administrative fee, or origination fee.

This payment generally covers the cost of initiating the lease and running a credit check on a customer. You may agree to pay it as a part of your upfront payment or roll it into your monthly payments.

Typical acquisition fees range from a few hundred dollars to around $1,000.

Guaranteed Auto Insurance or short GAP Insurance is a type of coverage that works for your protection and confidence during the lease.

It covers the “gap” between the amount owed on a vehicle and its actual cash value in the event it is totaled, destroyed, or stolen from a covered claim. It is optional and your lease expert will advise if it’s necessary for your car.

When you agree to the deal, one of your car leasing terms will include a fixed number of miles per year. It usually varies from 10 000 to 15 000 miles a year.

This amount may be negotiated and you may have to pay an excess mileage charge. A fee is typically from 10 to 25 cents per mile, and the details are specified in the agreement.

Deciding how many miles you’ll put on your car lease agreement is a very important part of the leasing process. It will impact the price of your monthly payments and it will be used to judge your vehicle inspection at the end of your lease agreement.

Tip: To get your annual mileage, choose a week that fits your normal driving habits and multiply the total miles covered by 52. After doing this, add in 5% extra of your total yearly miles for any unplanned journeys, this way you have some wiggle room in case you need it.

Most lease contracts allow you to incur “normal wear and tear” without having to pay an additional charge. But sometimes when you turn your vehicle in the company finds the damage beyond what is considered normal.

Typically the Excess Wear & Tear will include:

In case you didn’t follow the vehicle’s maintenance schedule, it’s also considered as an excess. Thus you may be held liable for paying the amount necessary to repair the parts.

But the details should be discussed with your personal lease expert beforehand.

Sometimes you see such promotional ads on websites like “Get the best deal with low initial payment”. Do you feel a little bit puzzled? What is a down payment? Should it be higher or lower? Do you have to pay for it?

Usually, you have a down payment first. In general, initial payment is not refundable and it also affects your monthly payment.

According to Carsplan, there are several types of zero down payment leases you should know:

A good credit score is between 620 and 680 because car manufacturers usually provide such zero down payment auto loans for high-qualified customers only.

So you have to improve your credit scores beforehand if you are not sure yours will work on you. It is better to prevent yourself from extra worries.

Your friend or relative as a co-signer of a leasing deal will be helpful here because it shows you are ready to split the costs and pay together.

It is a good way for those whose co-signer has a strong credit score showing reliability.

Choose an appropriate car because commonly such special conditions are provided for the most affordable vehicles on the market.

Honda, Hyundai, and Nissan offer such agreements the most frequently.

The beginning of the month is the golden time to find $0 down specials.

Commonly, leasing companies provide many new offers at the start of the new month.

You may check the needed numbers and use the Calculator to estimate your lease deal.

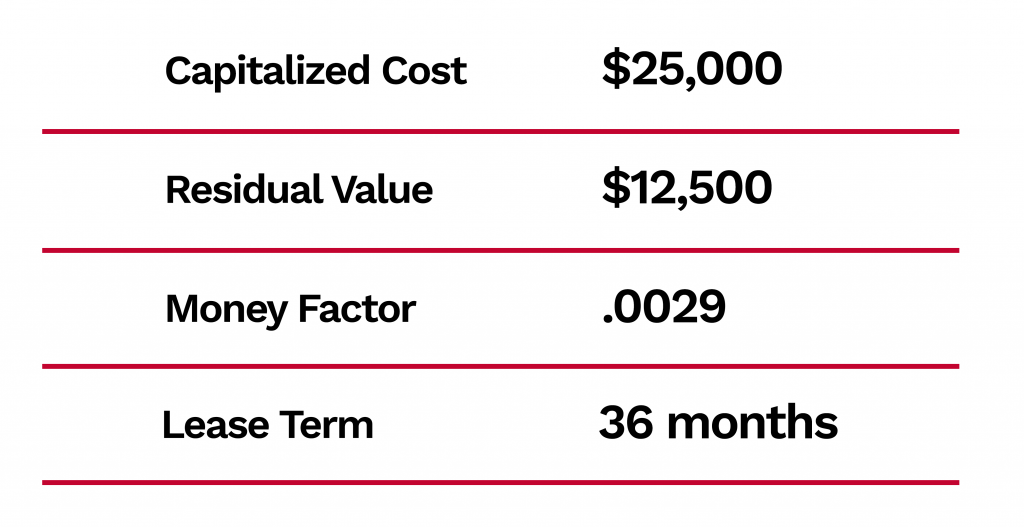

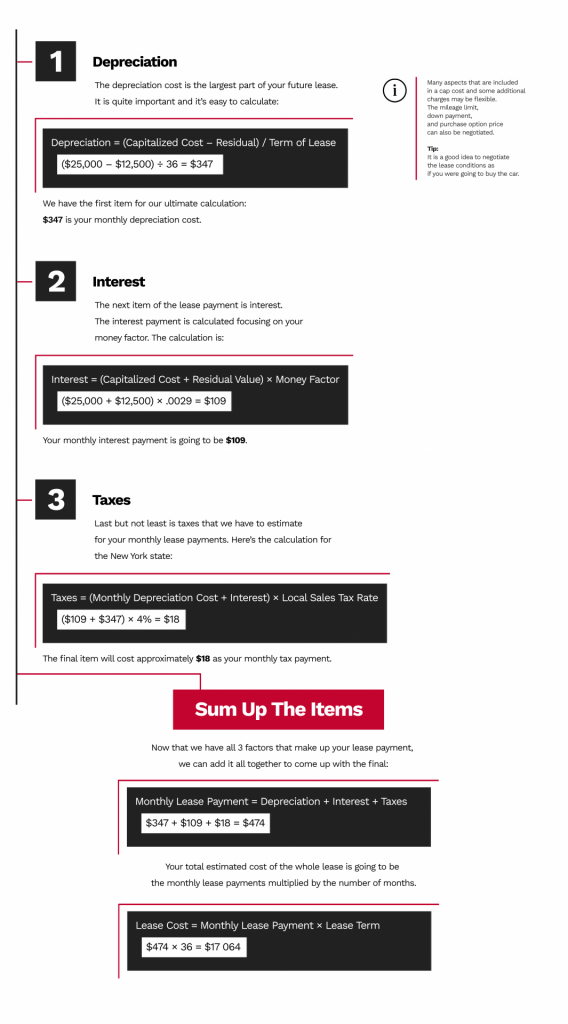

We’re going to take an example of the car you will be leasing with the manufacturer’s suggested retail price (MSRP) of $27,000. Let’s say that you agreed on the capitalized cost of $25,000.

Certainly, we will keep things simple not including any down payment and you don’t have a trade-in. The lease term will be very usual as for 36 months. The money factor is .0029, and the leasing company has predicted the residual value to be $12,500 at the end of 36 months.

Now when you know how does leasing a car work, you are ready to calculate your first lease. There are many different aspects of a lease contract, which means that your results will vary.

Don’t expect to calculate your lease payment to the penny. But if you base your calculation on accurate information, you can get close to the right amount.

Also, use our Calculator and plug in the figures that best suit your financial situation and lifestyle. If you don’t have enough information about the desired parameters don’t hesitate to get in touch with our lease expert here.

When leasing a new car the company will consider your credit score for the estimation of a total cost. Regard the score of 650 and more as an eligible one for the most vehicle-related loan and lease processes.

Just because your credit score is below 650 doesn’t mean you won’t be approved for a lease. However, you may have to pay more at the time of signing.

According to MoneyShake FICO use a rating between 300 and 850. It requires a score of 670 or over to be deemed as having “good” credit.

In case you happen to have a light credit profile, our assistants will work out the possible ways of a lease deal. It may include the qualified co-signer who might have a stronger credit score and be financially responsible for the deal.

What if you have a good credit score and you want to maintain it? Let’s see how does leasing a car work with bad credit and what are the tips and tricks to boost your credit score.

Of course, first and foremost is paying your bills accurately and with no delay to help raise your score. In fact, payment history is one of the primary categories reviewed by the credit card bureaus when determining your credit score.

FICO and VantageScore, which are two of the main credit card scoring models, both view payment history as the most influential factors when determining a person’s credit score. It indicates a person’s ability to keep up with their credit card payments and being reliable.

But your credit score isn’t just impacted by your credit card bills. You need to pay all your bills on time. That includes all your utilities, student loan debt, and any medical bills you might have.

To keep the track of your payments you may do the old-fashioned method of writing the due dates on a paper calendar. If you prefer a more modern strategy, there are many helpful smartphone apps for bills and budgeting.

When you get a credit card, you are handed the restrictions. If you want to keep your good credit score, you shouldn’t violate them. The meaning is never getting too close to your credit card spending limit.

Let’s say your credit card limit is $1,000. Now you will be attentive and spend your money within the 30% limit of that amount as that keeps you at 30% utilization of your card, and the credit score people like that. So you can spend $300. If you spend more than 30% of your limit, that hurts your credit history at all.

If you want to increase your credit score, though, you need to spend less than 30% of your spending limit. Only use $200 of your credit card limit or less as it shows the credit bureau that you don’t need all of their credit. This way it makes your credit score go up.

In case you really need to use your full credit card limit, you can do that and still build your credit score. One way to get around this is to pay your balance before your statement date.

Your statement date is different from your payment due date. The statement date is the day that credit card companies notify the credit bureaus of your card usage.

It can sometimes be hard to find your statement date and it’s better to call your bank or credit card company directly and ask them when it is exactly. If you can beat them to the punch and it’s reported, you can use more than 30% of your spending limit.

It doesn’t matter here what amount of money is there. The credit bureau considers you as a reliable client when you pay off your balance, in full, every month. It’s the habit that counts.

If you are considering opening a new credit card, do your research beforehand. It is very important that you don’t do it occasionally and without consistency.

How often you apply for and open new accounts get factored into your credit score.

Open your new credit card when you know for sure you can manage it effectively. Only take out credit if you know you won’t abuse it too much. Severe abuse of your credit is a more detrimental way than having a “thin file”.

Make sure you don’t apply to too many credit cards over a short amount of time and send a red flag to issuers.

When you receive your credit report, you should read it over carefully to ensure that all of the details and numbers are correct.

If you find any errors, you need to report them to the credit bureau immediately to have them removed from your credit report. If you don’t spot it on time, it may continue to harm your credit score, along with your chances of obtaining future credit.

About 25% of Americans have an error on their credit reports, so it’s important to review it.

Some common errors to look out for include fraudulent or duplicated accounts, as well as misreported payments.

You can get a free credit report from the three major credit bureaus: Experian, Equifax, and TransUnion. If you are not sure about some details of your credit profile and still hesitate to go for action, we are here to help you.

Click here to get your free consultation and have a detailed overview of your best options!

The leased car, especially a new one, always has a manufacturer warranty that covers the repairs and maintenance during your lease agreement.

But you have to be attentive that if you want to prolong your lease terms, the company won’t renew the car warranty automatically. In this case, we’ll consider how does leasing a car work in terms of maintenance and fixing works.

If you need to fix some problems you have to find a relevant garage to do the job. Thus, your first step is to contact your personal assistant and discuss the problem with your leased car.

Commonly, lease deals provide information about the kinds of garages you can go to. Sometimes you can choose the independent one, but usually, you take the car to a franchised dealership for your manufacturer.

Of course, every driver likes and cares about his auto. But often when you sign a lease contract you forget about everything and neglect the everyday maintenance of your car. It’s a totally wrong decision because even in case you have an extended warranty you may have to pay an extra fee for excessive wear and tear.

Tip: Maintain the leased vehicle as well as possible to protect you both from a quick break-up. Try to fix some small scratches and damages. If you don’t notice them, the lessor will do it for you at the end of your lease and you will understand how mistaken you were.

You have to negotiate this question with the leasing company but remember that it’s not always a good solution to find some garages on your own because it is a longer and more complicated process that requires only your attention without the help of your leasing company.

In case the works aren’t carried out according to the manufacturer’s standard the warranty will be invalidated and you will cover the cost of services. Also, you can have some extra charges from the company for your warranty loss.

Keep in mind that regular services can help you avoid some crucial errors and hold the shape of your car. You can find in your lease agreement how maintenance works in terms of leasing a car and how often you should service the vehicle.

When leasing, determining how leasing a car works when it comes to repairing and warranty costs may be puzzling for consumers.

There are questions like “Do I have any warranty at the beginning of a lease?”, “Do I need to get an extra one?”, “Is it worth extending my warranty?”, “Should I consider insurance?” and so on. Well, let’s make it clear bit by bit toпether.

If you lease a new car, a coverage plan is provided by the original manufacturer of the car. The factory warranty will cover any mechanical repair, not due to accident, abuse, or normal wear and tear condition. So, be attentive with the damages to make sure they are covered.

However, there are some exclusions. Some wearable parts may not be covered by some manufacturers past an initial period such as:

Each manufacturer sets its own criteria and you should carefully study how does leasing a car work while signing the papers.

Usually, the factory warranty works for a period of time that often expires before the end of the lease term. Nearly all new cars come with at least a three-year, 36,000-mile bumper-to-bumper warranty. For many brands, the warranty is even longer.

Once it expires, you are the one responsible for the state of your car and you will have to cover all repairs out of your pocket.

Usually, states have their fixed requirement for car insurance but leasing companies sometimes offer their own ones. It looks not attractive at first because you see that you have to add some extra dollars (not a few) to the minimum price. But this system may save you out-of-pocket expenses! Bankrate describes whether it’s worth having this type of insurance for you.

Tip: Take the gap insurance which is always provided by our company. This typically means that the insurance company will refund the difference between the market value of the vehicle (provided by the insurance company) and the price provided by the lessor. And then you will be able to change the car.

You are probably excited, knowing that you won’t have many repair costs on your new leased car. Since everything should be under the vehicle’s factory warranty. Although when you know how does leasing a car work, insurance for the leased car may be quite high in price.

Moreover, insurance rates for leased vehicles vary just like insurance for any vehicle, based on various factors such as

Rates differ depending on many factors but you can use our car insurance calculator to get a better estimate of what to expect.

Sometimes you may find yourself in a situation when a car lease might no longer work for you.

Maybe your current car doesn’t fit your needs anymore, you feel like driving a newer model or you are having trouble making payments.

So it’s probably high time for your early end of the lease.

For sure you don’t want to make your credit score drop, yet you may be considering terminating your car lease early. So, how to avoid losing money in this situation?

It’s a vital thing to be careful and attentive with the documents if you don’t want to meet face-to-face with lease termination problems and so on. Often drivers don’t think about different details because they’re sure everything is discussed and they can just relax and drive. It’s so close to that moment but don’t forget that it’s your auto for a while as well as your responsibility.

Tip: Just try to look through the fine print carefully and check the details of the end of the lease and some fees refer to that, the initial payment and residual value and their influence on the monthly payments. Also, you should check if anything is mentioned about the opportunity to buy a car at the end of your lease term because this option is often possible.

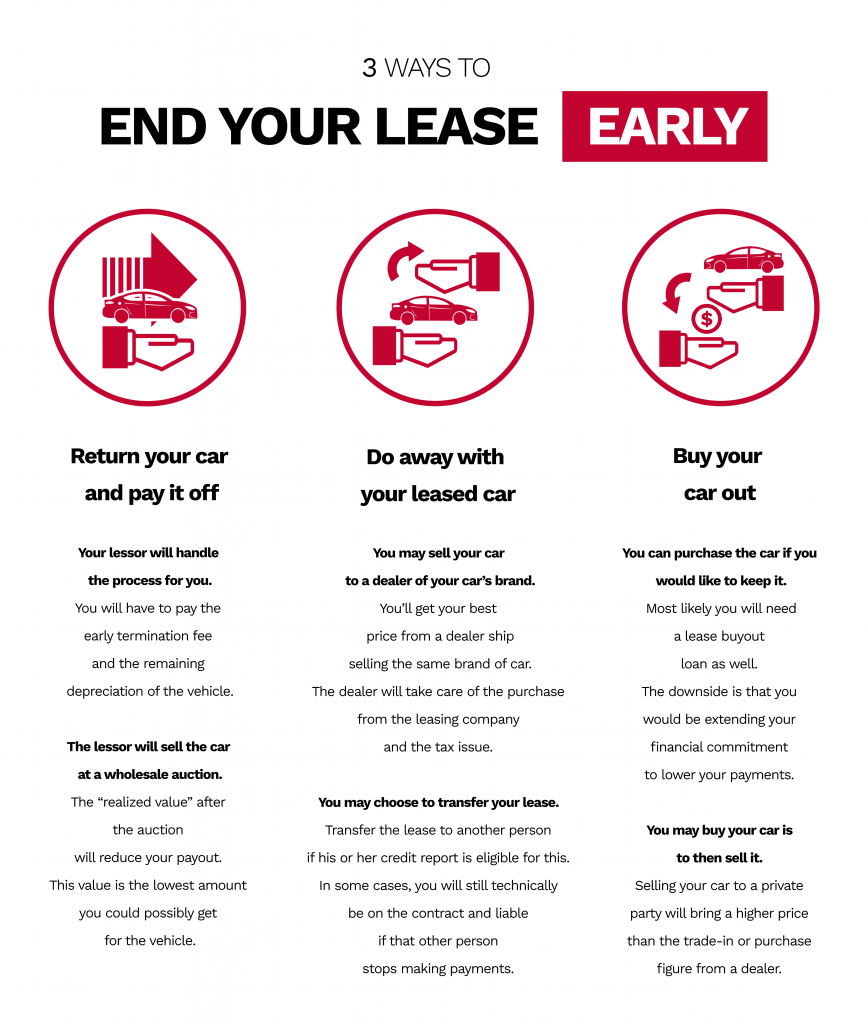

Fortunately, early termination isn’t your only way, and it’s better to consider other options.

Yes, it’s the easiest and most expensive way. Your lessor will handle all of the details for you.

Instead, you most probably will have to pay the early termination fee, as well as the remaining depreciation of the vehicle.

After that, the lessor will sell the car at wholesale auction and reduce your payout by this “realized value”. This value is the lowest amount you could possibly get for the vehicle.

It’s hard to name this way the money-saving one and if you’re desperate to get out of the lease, it can be due to financial issues. Check other options to save as much money as possible.

You’ll get your best price from a dealership selling the same brand of car you’re looking to unload. Pickups and SUVs are in high demand now and might be more profitable to sell.

The value and desirability of sedans and other vehicle types will depend on the popularity and availability of those brands.

The main benefit with the dealer is that they will take care of the purchase from the leasing company and you won’t have to worry about the tax issue.

Although if the residual value of your car was low and your payments high, you might still be on the hook for a lot of money.

Knowing the fees you might be charged for may be unpleasantly surprising. So it’s better to make sure you know what things you are responsible for.

Tip: Check breaking lease penalties that might be included into your agreement. Among them may be an early termination fee, costs related to preparing the vehicle for sale, taxes associated with leasing, negative equity between your lease amount and the current value of your car, and so on.

Transferring is a good idea to end your car lease if it is legal according to your state laws and permitted under your lease contract.

Most leasing companies allow you to transfer the lease to another person if his or her credit report is eligible for this.

Keep in mind that in some cases you will still technically be on the contract and liable if that other person stops making payments.

You should carefully look for a trusted party you’re transferring the lease to who meets your lender’s credit requirements.

Also, you will have to pay a transfer fee which can range between $50 and $500. For each particular case, it is better to double-check to see if it’s cheaper than early termination.

When you buy your car, you actually get equity in your vehicle and from now on you can do whatever you want with your auto.

You can purchase the car if you would like to keep it and most likely you will need a lease buyout loan as well.

The downside is that you would extend your financial commitment to lower your payments.

Another way you may buy your car is to then sell it. It is quite a tricky way and it’s better to be well-equipped with the knowledge of the market fluctuations and the real current value of your vehicle. You can do this through websites such as Kelly Blue Book or Edmunds.com.

This way you can either purchase the car with ready cash or take out a loan to cover the expense. Selling your car to a private party will bring a higher price than the trade-in or purchase from a dealer. However, it will require time and money for advertising to find a buyer.

On one hand, it is always good to follow the common strategy of excellent lease — just start and finish it by the contract.

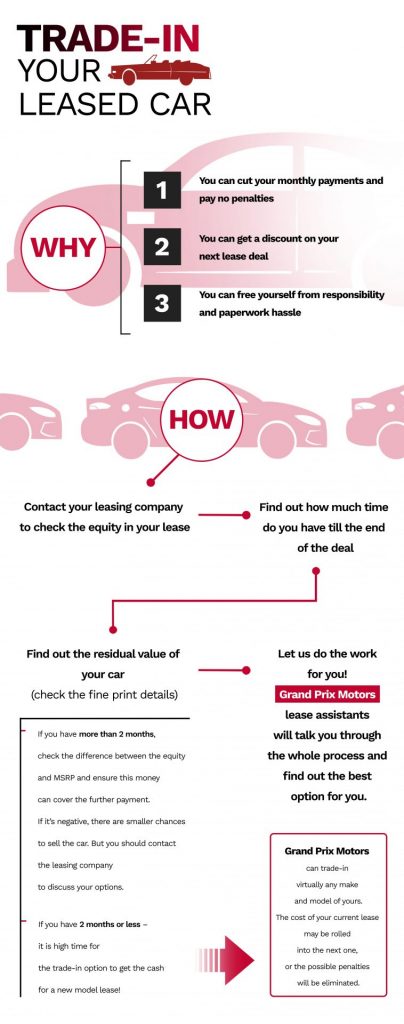

Some will say that early termination can cause many extra fees and penalties. Though trading in a leased car may be your best solution on the modern market.

It is the cost-effective process that helps you to pay less for the car at all while other customers will have to pay more for the leased car.

No hassle with selling the car because you don’t worry about anything. Every important action is done by your company.

The opportunity to avoid some extra fees for not enough care and breaking the annual mileage.

The statistics show that fortune is on our side this year. Drivers trade their leased auto in to get the profit and new opportunities! You can stop driving it a few months before the contract termination, negotiate a good deal with Grand Prix Motors and keep driving the latest model car for a little money. It seems like a tricky way and we will agree with such words. However, we live in a modern world of innovations and technologies, so we can afford to be a kind of hacker. By the way, why is it good to trade your leased car in?

Good idea to go cooperate with brokers who sell the same car as yours. Grand Prix Motors can trade-in virtually any make and model of yours.

The cost of your current lease may be rolled into the next one, or the possible penalties will be eliminated.

Our lease assistants will talk you through the whole process and find out the best option.

Be attentive that all the offers we provided as examples are not appropriate for everybody. The lease deals can differ according to your habits, credit score, and lessor.

Contact your personal GPM assistant to negotiate your personal deal and the possibility of trading it in! You are on your way to the unforgettable driving experience.

#enjoy your freedom with Grand Prix Motors!

Hear about the latest offers first, before everyone else.

Submit your desired Car and we will contact you shortly.