Some people believe that leasing a car with bad credit is impossible. However, car leasing…

Whether your car lease comes to an end and you no longer want it, or you think of taking over someone else’s car lease, you naturally have some double thoughts. Should you consider a car lease takeover? Is it worth it?

Having many options to choose from, you definitely should do one thing beforehand. No matter what kind of vehicle you have, you’ll want to know where you stand before ending your lease.

Examine the fine paper very carefully, particularly in the sections that cover information about the residual value, buyout possibilities, extending chances, transfer allowance, and your penalties in case of early termination. You are going to learn about each particular notion in every practical way at the end of a lease. Let’s start with the most common options.

1. Return your car to the company

The easiest and most common way to end your car lease deal is to return the vehicle to the lessor. This way, you fulfill the basic agreement and also surpass the car check.

We prepared a brief checklist for returning your leased car:

Don’t forget that most probably you’ll owe a disposition fee, mileage charges if applicable, and any wear and tear charges.

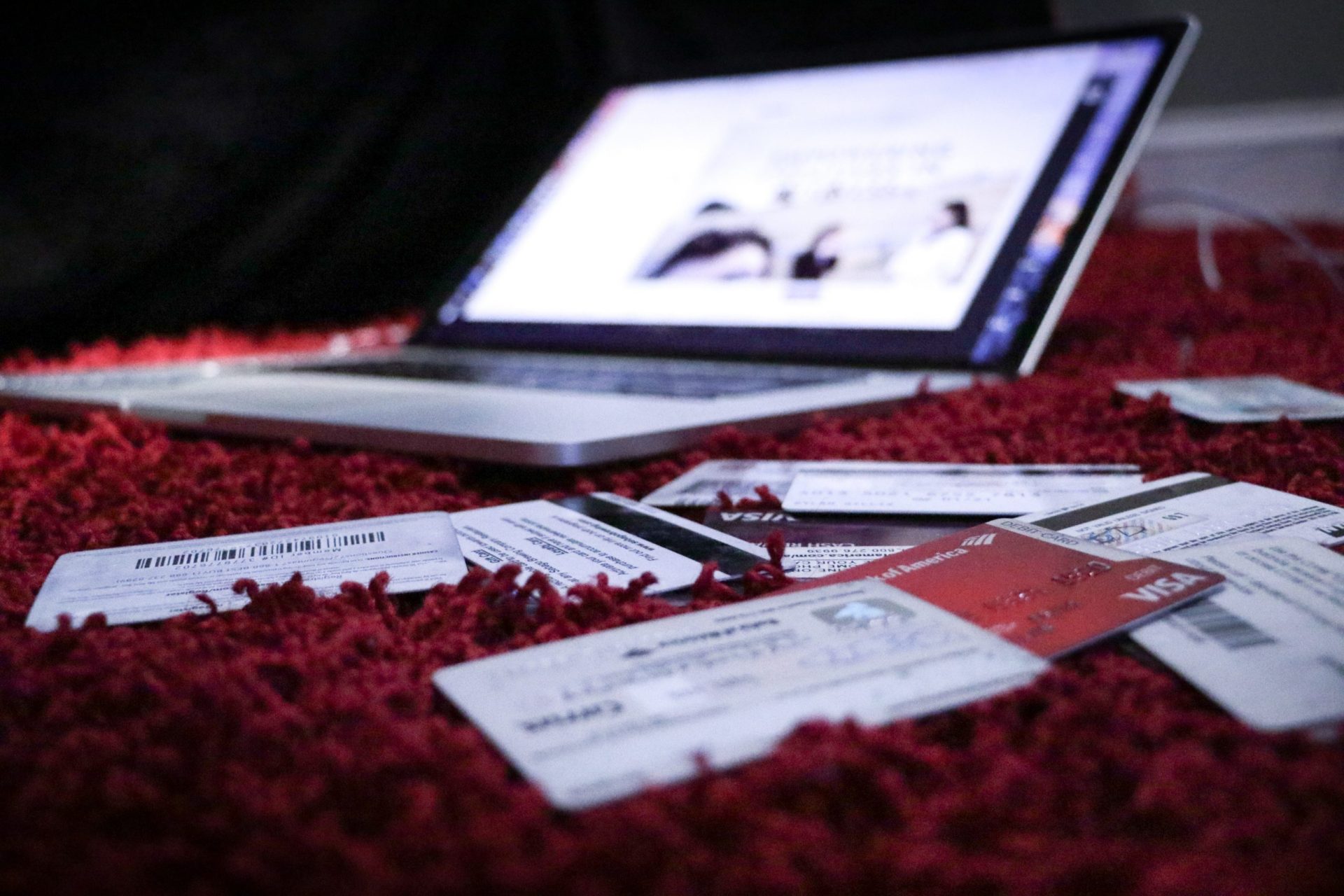

2. Takeover a car lease

We mentioned here 4 ways to end your car lease deals, so you may have a more detailed overview of these options. If you aim to finish the lease term before it ends, you can trade it in anywhere for any make and model you wish. You are not tied to the dealer you leased from in any way. By trading, you avoid the disposition fee, mileage charges, and wear and tear. After agreeing on a price, the lender typically buys your contract directly from the leasing company and gives you a check for any remaining value.

You can also transfer (sell/swap) your lease car to a third party, but you need to be really careful and check with your agreement if the initial contract allows this option. You can either pay off the lease and then sell your car, or just sell the current lease deal to a third party. Typically, you’ll make more money by selling your car to a private party, but you’ll likely have to pay sales tax as a consequence. Again, this kind of action is quite controversial and it’s better to have a consultation with a trusted lease expert in order to be on the safe side and don’t be stuck in a financial situation.

Another option for breaking a lease early is to sell your car through the buy-back program and receive cash in return. Grand Prix Motors will purchase your car out if it is in otherwise good condition and is either yours or a leased vehicle. For the early lease turn-in deals, we will make you an offer that is over market fair value. Deals that would expire in more than a year can be bought out by us while still generating extra revenue for you. In addition, you can earn a $200 incentive by referring a friend or coworker to our buy-back program.

3. Get a new car lease deal

You can exchange the vehicle in order to invest in a new lease from Grand Prix Motors as another option of the buy-back program. Even before your current lease expires or when it does expire, you can frequently roll it into a new one straight away. Moreover, your lease payment may be reduced if you trade it in for a less priced car.

You may put the value of your current car toward the down payment on a new one. Once you are aware of your equity, you can take your vehicle to the leasing company to exchange your current lease for a new one. Make sure all the numbers add up before proceeding.

As an alternative to paying those costs out of pocket, you can also use the equity to pay the fees necessary to start a new lease. In any case, you make money when you trade in your lease early for a new vehicle.

Another way you can take advantage of a lease pull-ahead deal. Although it’s usually available a few times a year, you could still catch it. Thus, the dealership waives the last three payments on a lease when you take out a new one with them.

It’s an incentive offer designed to keep you as a customer and move certain vehicles off the lot. Aside from skipping out on the last three payments, you typically don’t have to pay for going over your mileage limit if you drove more than expected.

4. Buy your lease car out

It might be worthwhile to buy your car when your lease ends, especially if you damaged the car or went over the mileage allotment. Besides, you’d prefer to spend the money you’d have to pay in fees on buying the car instead. Maybe you really got used to your leased car and just feel like keeping it.

You have the first right of refusal to purchase your leased vehicle for the residual value. If you do not purchase it, the dealership has the next opportunity. And if it does not purchase it, the lease company gets it back and sends it to the auction. Like trading your vehicle in, if you purchase your leased car, there are no fees or charges.

Keep in mind that you will have to pay sales tax and DMV fees again if you choose to buy the car. It’s better to read the terms of your lease and examine the condition of your car to figure out if this option is right for you.

Choosing a car lease takeover relieves you from the monthly payments and also takes care of any documentation hassle. Using the help of your leasing company or the advice of Grand Prix Motors can save your effort. Check our buy-back program to make some money or let us do everything for you. Contact us to get a transparent and detailed review of the best options for you!

#enjoy your freedom with Grand Prix Motors!

Hear about the latest offers first, before everyone else.

Submit your desired Car and we will contact you shortly.