Having the car provides you with the necessary life comfort. However, there are hardly any…

New decisions in life are always exciting and scary. Usually prior to starting something you read a lot of articles, watch videos, talk with friends to find out about some experiences, and get a piece of advice. Here we’ve gathered some reliable information about car leasing. Grand Prix Motors experts will share the most important facts about the costs to make you aware of the car leasing calculator!

Everybody who came to the leasing company has the same question: how much should I pay? It is an obvious issue to discuss because you are on your way to having a new car and you want to ensure you know all the details.

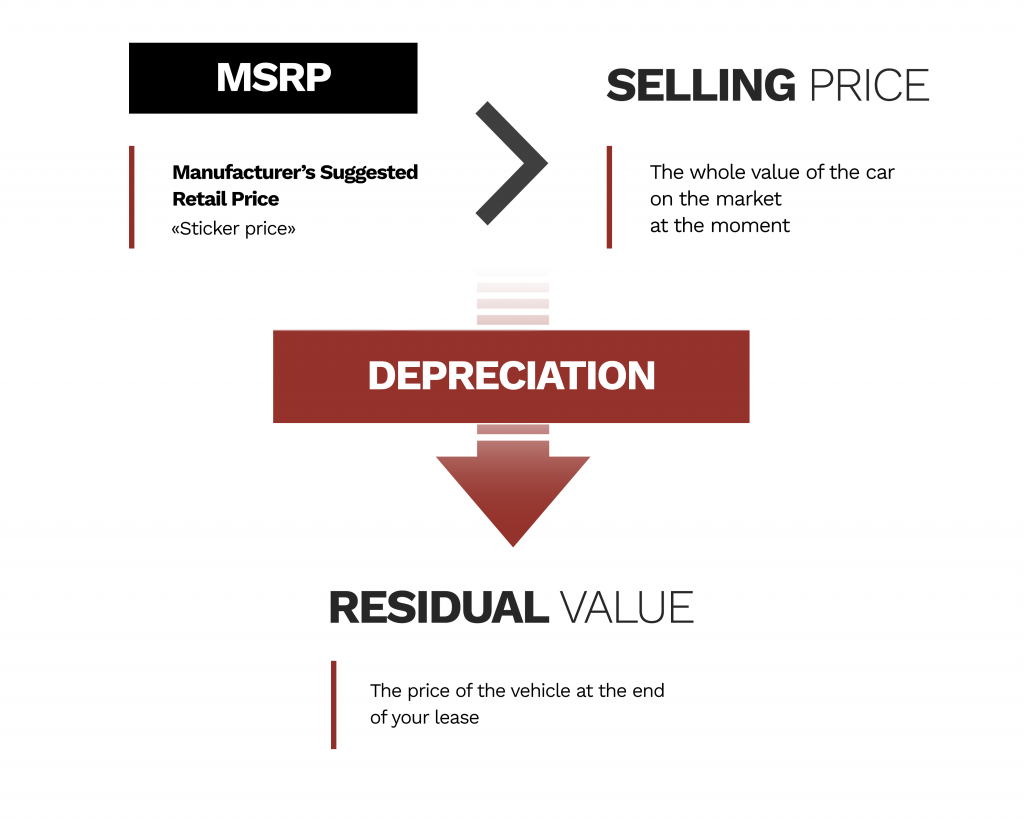

First, you have to understand the major cost of your leasing which is based on depreciation. When car shoppers just come to the lessors, they will find out the Selling Price (not MSRP*). It is the whole value of the car on the market at the moment.

Then, your leasing provider will tell you the Residual Value. It is the price of the vehicle at the end of your lease. It helps the car dealers understand what will be the price of your car to re-sold it when you finish using it. Depreciation shows your major payment as a value that the car loses during leasing.

Car Depreciation and Residual Value are provided by the company and based on the previous data of usage and forecasting according to the latest trends. The only way for the customer to help themselves to calculate the lower price is to choose such cars which tend to depreciate less than usual.

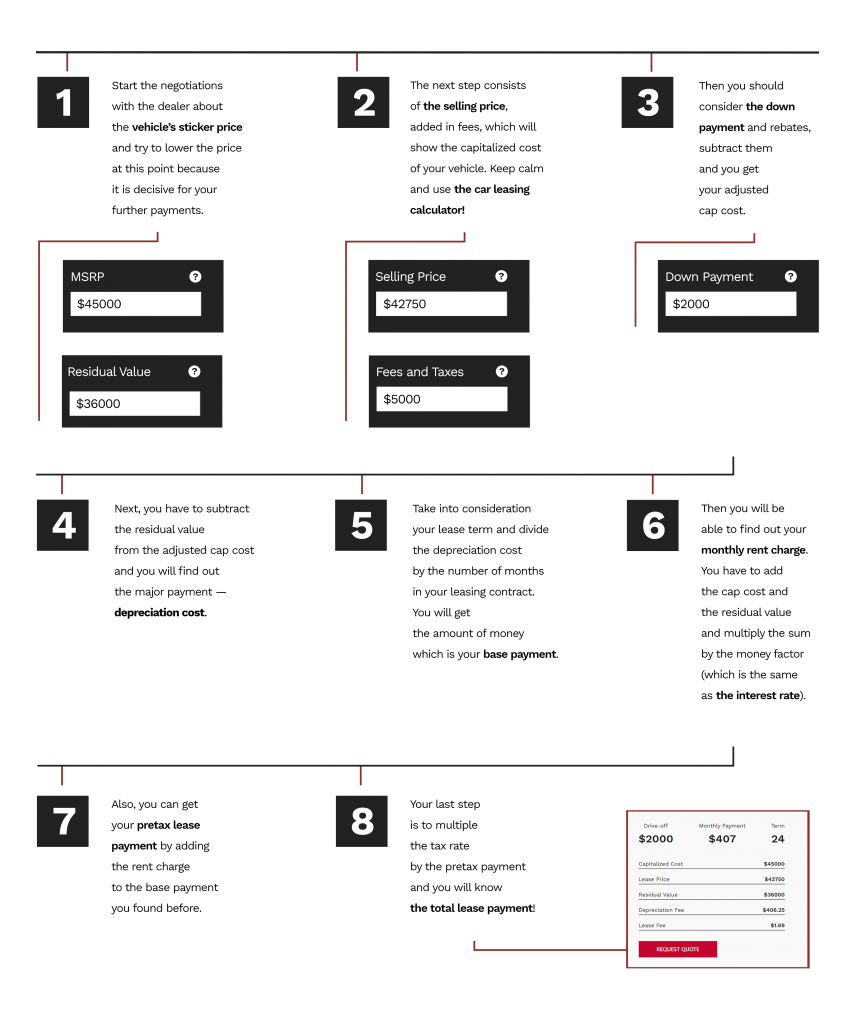

The Down Payment is provided by you and it’s not obligatory. The customer can make the initial payment if he wants to lower his monthly payments.

The Capitalized Cost is the vehicle’s price, including fees and taxes without a down payment. It will be the final negotiated cost.

*Don’t confuse the Selling Price with MSRP — Manufacturer’s Suggested Retail Price. It is a part of your total cost. MSRP or sticker price is an opening mark of the discussion with car dealers but it’s not the final point.

Commonly, you can take the discounts and extra bonuses into attention. It works on your behalf because by any incentives and further negotiations you can lower the price and save your money. The lower the selling price is the less your taxes and monthly payments will be.

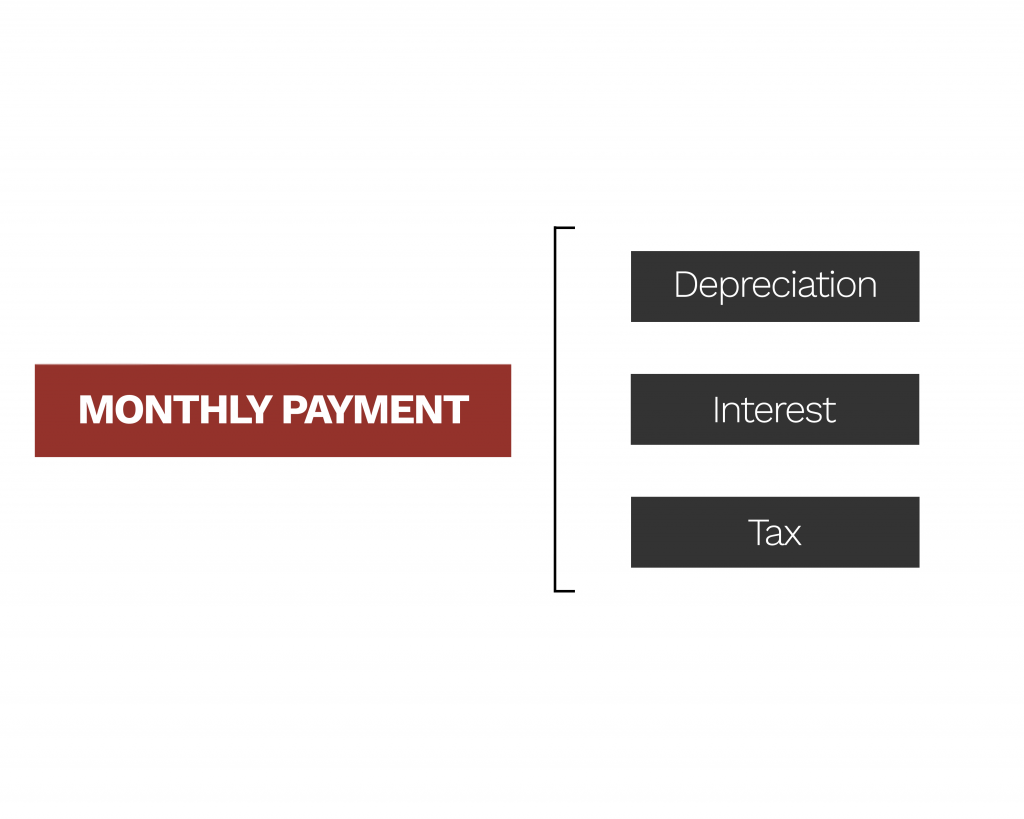

Your regular monthly payment includes depreciation, interest, and tax. By adding up these numbers you will be able to get the amount of money you have to pay every month.

In general, it is not difficult to calculate them by yourself. For example, we will provide you with the car with the MSRP of $30,000. After some negotiations, we discussed the price of $25,000. Your leasing term is determined for 36 months. The money factor is shown as .0027 and the residual value is predicted to be $13,500 in 3 years.

Your monthly payment is about $319, the potential monthly interest payment is $104, and you can expect to pay a monthly tax payment of $30. In total, the monthly lease will be $453. How did we get this number?

Click here to discuss the case with your personal assistant and arrange your lease! Or you can keep reading, follow the instructions and try to find out the potential price on your own!

In case, you want to buy or rent the vehicle you have to ask about the lease or purchase price. It’s a decisive step for both sides in the cooperation. You should be aware of all the costs you will have and we want to provide you with this information to make sure that these conditions are affordable for you. It will make further cooperation much faster and easier.

If you have any questions or you’re already decided to lease a car, click here to contact your GPM personal expert.

#enjoy your freedom with Grand Prix Motors!

Hear about the latest offers first, before everyone else.

Submit your desired Car and we will contact you shortly.