Nowadays the business and sales sector can share the bad news with a society that…

Investing in a long-term commitment may raise a lot of concerns. Sometimes just finding a “lease vs. buy automobile calculator” is not enough. And you start looking through the tons of options, researching the benefits and drawbacks of leasing conditions in 2022 or buying a car this year, and figuring out the details.

Does this sound familiar to you?

Let’s do it faster with a quick overview or you may contact our lease expert for a more detailed consultation.

To know more about the pros and cons of both, watch an exclusive interview with Grand Prix Motors CEO Lenny Komsky to find out whether car leasing in 2022 or buying is right for you.

Those might be the first questions that come to your mind when you start thinking about how to lease a car. We’ll try to address them by first outlining the main financial benefits of leasing.

When leasing a car, you will rent a brand new auto that is usually covered by the manufacturer’s new-car warranty. Additionally, you use the vehicle in its most trouble-free years. Most users replace their models every three to five years.

Cars often become outmoded every few years and are replaced by newer models with improved technology and technical assistance. Thus, Grand Prix Motors clients can utilize a new car with complete up-to-date technical support.

So choosing leasing you only pay for the depreciation of that period and not the whole car cost. Roughly speaking if we take the same make and model vehicle and compare, leasing will be more beneficial of a financial matter. When leasing you get a new car while making way lower monthly payments. Buying a new car upfront means you will pay the full retail cost divided into monthly parts.

In other words, the situation with purchasing a car is completely different from car leasing.

· You have to buy a new warranty every time the old one expires.

· Сar value drops immediately after you leave a showroom or get into an accident.

· You have to cover all damages to the car with your own money as long as you own it.

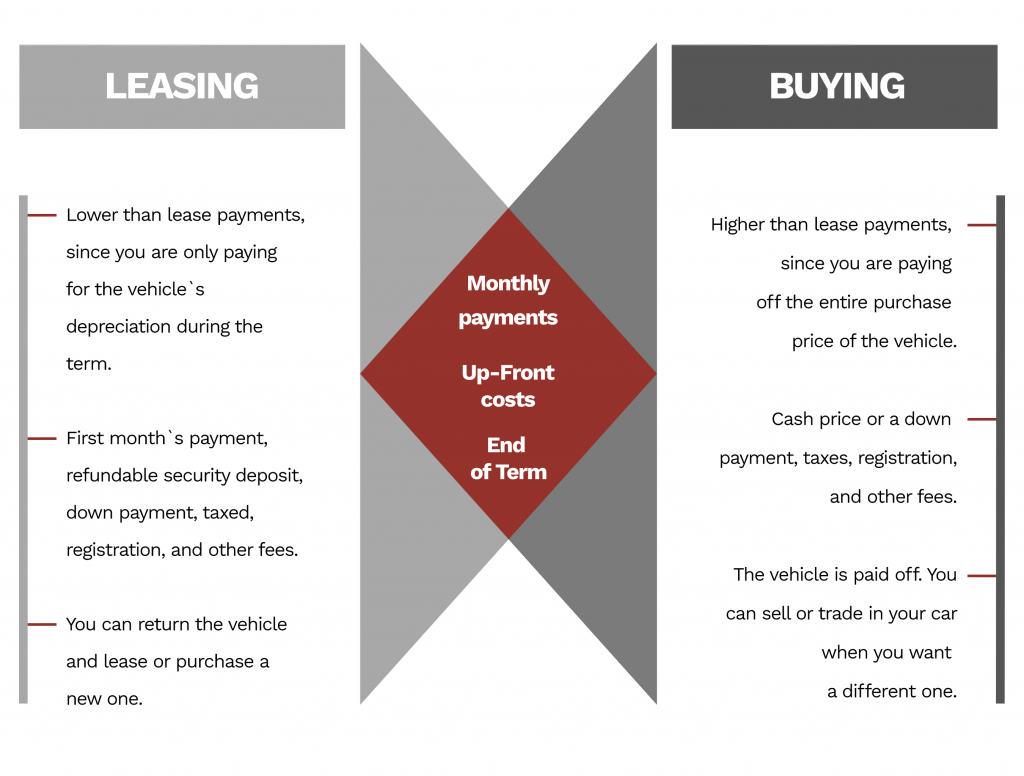

When choosing between leasing and buying, the price question always plays the most important part. Buying a vehicle with a car loan you choose higher monthly payments for some number of years. With each payment, you put part of it towards paying interest on the loan, and the rest is used to pay down the principal. Some car buyers opt for longer-term car loans of six to eight years to get a lower monthly payment. But in this way, you may get an ‘upside down’ effect when you owe more than a vehicle’s price.

A clear difference comes with a car lease deal, as leasing a car offers you a new car to drive for significantly lower monthly payments with fixed conditions.

You may look for a “lease vs buy car” calculator on the internet or use ours. Grand Prix Motors lease experts may advise you on the best option of down payment to make your monthly payment even more affordable. To contact your personal lease expert click here.

Leasing provides you with an option of zero down payment while buying doesn’t. It practically means that when you get a new car lease you don’t make a deposit upfront. Instead, when you get a lease deal, you may choose to pay your first month’s payment and fees (refundable included) and drive off your nice new car straight away. If you choose to buy a car, you will have to pay the cash price of the down payment, taxes, registration, and other fees.

When you own a car, you are able to drive as many miles as you can afford. Thus, buying makes it possible to only maintain the repairs of a car after that. Leasing has some mileage restrictions though, and with more people than ever working from home, it may not be a factor. Many might find they don’t use the miles they have paid for.

If you are financing a car after your loan is paid off, you own the car and you have the freedom to do whatever you want. Yet, after some years the market changes and you will need to take action, look for the options of selling or trading–and it’s a bit of a headache.

Unlike leasing, after your contract is over you are free to get another newer and better model for a reasonable price. With no hassle of paperwork and trade deals, the lease company takes care of everything so you may enjoy the benefits of your new car. Up for leasing? Discuss all the details with a Grand Prix Motors lease expert.

It is only fair to mention the whole picture that you might face before you arrange leasing.

· You are obliged to do monthly payments.

· Returning fees apply if you exceed your mileage limit or damage a car.

· The cost of insurance is likely to be high.

Therefore, financing your automobile purchase is a crucial step. You make the commitment and want to be confident in the investment you choose. Even while purchasing and leasing may look fairly comparable, there are still significant distinctions. Regardless of the situation of the market in 2022, taking out a car loan puts you in a dependent position for a number of years whilst a car rental deal conditions change every few years along with the chosen automobile.

Buying a car on lease in 2022 is a good way to save money and make use of a nice new vehicle, as it gives you a chance to spend your finances wisely with relatively cheap monthly payments. If your goal is to have low monthly payments and drive a new vehicle every few years with little hassle, then leasing is definitely your choice.

There is no need to stress about the market change and depreciation as if you had to trade-in your pre-owned auto. A good place to start is with the lease vs buy car calculator so you know you’re getting the real deal. Grand Prix Motors simply provides you with a door-to-door service so that your car is literally delivered to your place. Leasing makes the idea of having a car easier, more affordable, and customer-friendly. Ready to consider your car lease options?

Ready to get a new lease? Request a custom quote!

#enjoy your freedom with Grand Prix Motors!

Hear about the latest offers first, before everyone else.

Submit your desired Car and we will contact you shortly.