Nowadays, leasing gains popularity among car owners who are choosing to lease cars rather than…

The leasing process gains popularity steadily and you probably wonder why. We will make it easy to understand how leasing a car works. But first, let’s answer a few questions.

A car lease is an agreement between the company that owns or will buy the car and the person who will pay to rent the car. This agreement is normally signed in a form of a contract for a certain length of time.

After this term ends there are options like returning the vehicle to the company or purchasing it at a predetermined amount, which is defined in the lease contract.

Leasing a new car offers many benefits to enjoy. Let’s take a look at how they work.

There are many factors affecting the rental process. So, we’ll try to figure out how leasing a car works and why leasing may be more appealing than buying in 2021.

If we compare leasing to financing on the same vehicle, the lease payments will generally be lower than the monthly loan payments.

When buying a car you have to pay the full retail price of the auto with an interest rate, taxes, fees, and the down payment. While leasing you only pay for the depreciation of the same car for the term you use it. Of course, you are going to cover some expenses like the first month’s payment, refundable taxes, fees, and possible down payment. Although the cost difference is drastic.

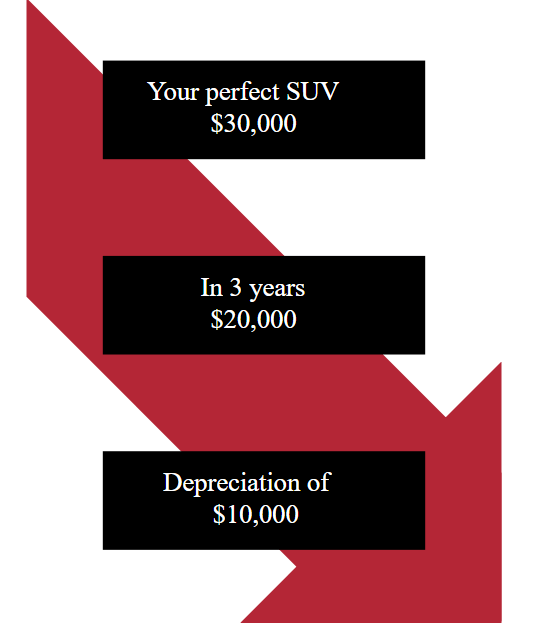

Let’s take as an example your perfect SUV for the $30 000 retail price.

In about 3 years of use, it is expected to be worth $20 000, while the depreciation will be $10 000. If you choose to lease your monthly payments are going to be based on this amount plus the interest rate with fees. On the other hand, if you choose to buy your auto, the cost of the deal is going to be based on the initial price tag plus all the additional fees and taxes.

Same make and model, same term of use but the prices differ significantly.

Leasing lets you get a new car every couple of years because of a short-term commitment.

For instance, imagine your nice brand new car, complete with the latest bells and whistles, fresh polish, and the smell of the leather. You enjoy the benefits of a new car as it will generally be covered by a manufacturer’s warranty. And you don’t have to think of its maintenance, upgrades, and constant repairs, that’s how leasing a car work.

A lease may require a smaller or no down payment than purchasing a car with a loan.

You should bear in mind that the lease cost also depends on the up-front payment and the monthly payments may be slightly larger as the interest rate may rise. Check out our detailed guide on zero down payments.

Some taxes are refundable for lease and loan though leasing gives you a great chance to save more. If you use your car for business purposes, a lease will often afford you more tax write-offs than a loan.

The Internal Revenue Service allows you to deduct both the depreciation and the financing costs. Leasing includes both these subjects in each monthly payment.

You don’t need to worry about the market fluctuation, your financial risks and look for the selling deals at the end of the lease.

When you buy a car you will most probably deal with trading in, depreciation, selling, and so on. How does leasing a car work here? It allows you to drive the latest-model cars every couple of years. Moreover, the company takes care of everything and you are free to choose your next new vehicle. If you want to know what is your best car lease deal our lease expert will contact you with a free consultation.

Capitalized Cost or “cap cost” is the amount of money you pay for the car lease. To clarify, cap cost includes the negotiated price of the vehicle plus any add-on fees or taxes.

Money Factor is a financing charge that you will pay on a lease and it is normally based on your credit score. It is a notion similar to an interest rate paid on a loan. To convert the money factor to a more familiar interest rate, you multiply it by 2,400.

Mileage Allowance is the number of miles you are allowed to use per year. It is agreed on every particular car individually with a customer and signed in the contract. In fact, the normal mileage limit is from 12 000 to 15 000 miles a year.

Acquisition Fee is an amount charged for setting up the lease. You’ll normally have to pay the fee as part of your down payment or as part of the monthly payments.

Undoubtedly, you have a particular vehicle in your mind that you’d like to drive. Choose the particular manufacturer, make $ model, year of release and think of your lifestyle. What car is perfect for you? Sustainable 7-seat SUV, convenient family-oriented minivan, or simply a comfortable sedan? If you struggle to define it, click here to contact our lease expert who will help you and find the best option for you.

Above all, the company will look for all the options to consider for you. Though you may be specific with the financial input you are ready to make. There is a great variety of choices of affordable and luxurious lines.

You may also want to regard the possible down payment. If you are ready to put some money down it will make your monthly lease payments lower as the money factor (interest rate) will decrease.

Think of the lease term that would work best for you. For example, you may choose from 3 months, 1 year up to 5 years lease of a vehicle. The lease expert will look for the options to suit your preferences.

You may use the Calculator to estimate the approximate criteria of your future lease. By calculating your own lease you can account for factors specific to your deal, like annual mileage, vehicle MSRP, tax rate, targeted incentives, and so on. Otherwise, you can let our lease expert do it for you. Get your Free Quote right now

After you get your best deal it’s time to sign the contract and enjoy the benefits of your new auto. With Grand Prix Motors all the steps may be done online to secure you at this time of pandemic and save your time. Your car will be delivered to your home or office within 48 hours.

Leasing a car in 2021 is a good way to save money and make use of a nice new vehicle. You agree on up to a 5-year leasing contract with some conditions. It gives you a chance to spend your finances wisely with relatively cheap monthly payments. You have your down payments, fees and warranty covered after the negotiation process. Short-term commitment makes your life easier without the hassle of constant maintenance.

There is no need to stress about the market change and depreciation as if you had to trade up your pre-owned auto. Leasing makes the idea of having a car easier, more affordable, and customer-friendly.

#enjoy your freedom with Grand Prix Motors!

Hear about the latest offers first, before everyone else.

Submit your desired Car and we will contact you shortly.